Understanding Visit Limits in Pediatric Therapy

- What does understanding visit limit mean in Pediatric Therapy mean?

- What is the difference between hard and soft visit limit?

- If my visit limit says 60 visits, why does my insurance not let me use all those visits?

- What does “Medically Necessity” mean? If I have 60 visits why is insurance saying it’s not medically necessary?

Visit Limit

is a set number of visits your plan will consider for services for the year. For Pediatric Therapy, this may be a combined visit limit for any/all services. It could also be a separate limit for Physical, Occupational, and Speech Therapies.

Hard Limit

is when your insurance company determines a set number of visits per year, such as 30. They will not pay for any therapy services once you have reached that number. As a result, if you choose to continue to treat after your hard max, those services would be your full responsibility, and will not be applied to your insurance deductible, co-insurance, or out-of-pocket expense.

Soft Limit

is when your insurance company says they are allotting a set number of visits, such as 30, BUT they will consider additional visits beyond that number based on their determination of medical necessity. They would review medical records, and determine if therapy services are warranted, and could choose to allow or deny additional visits based on their review. And note, extra visits are not a guarantee.

My plan says I have 60 visits, and I was cut-off at 40. Why?

Some insurance plans will say your plan has a set number of visits, but that does not necessarily mean you can “use” all of them. Many times, insurance companies request medical records from your Pediatric Therapy provider, and perform their own independent medical review. They can determine at any time, services are no longer needed. If that occurs, you would be financially responsible for those services.

What does Medical Necessity mean?

Many insurance companies have outside review companies they partner with to review records. They determine if they “feel” services are warranted, or a patient can be discharged from care. In short, f the reviewer determines that visits are not medically necessary based on their criteria, they will no longer cover services.

Written by Ann Marie Johnson

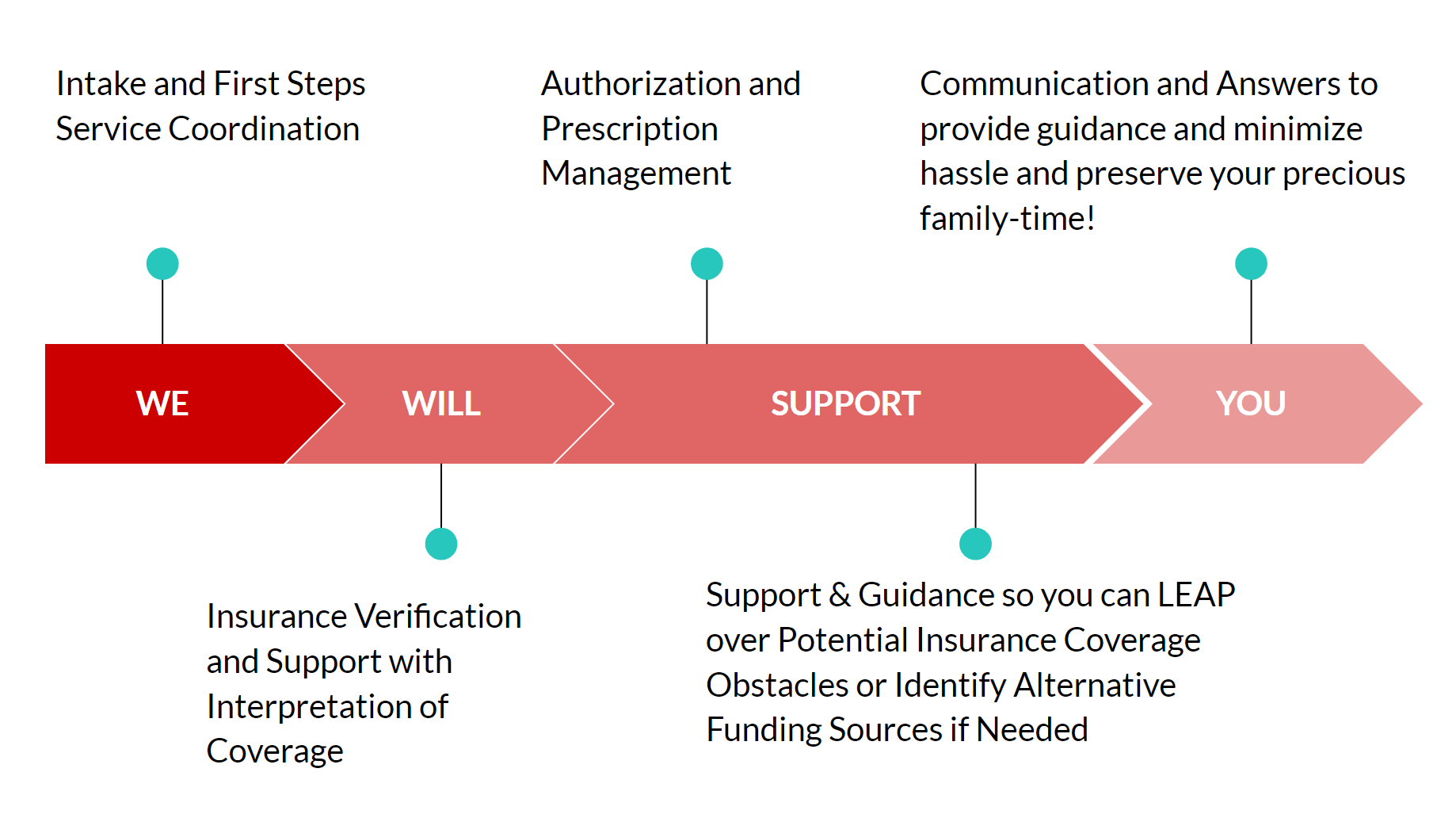

Click here to schedule a phone call with a Next Steps Coordinator if you have questions or call us directly at 708-478-1820.